Stimulus Check Realities: What You Need to Know

The landscape of stimulus checks has shifted, leaving many Americans with questions. Were there more checks on the way? How do you claim any outstanding payments? This article breaks down the facts surrounding stimulus checks, specifically focusing on the situation in 2025. It addresses the deadlines, the possibilities, and the best ways to track your tax refunds. Navigating the complexities of government assistance can be challenging, but understanding the timelines and available resources is essential for making informed decisions about your finances. This information aims to provide clarity and guidance.

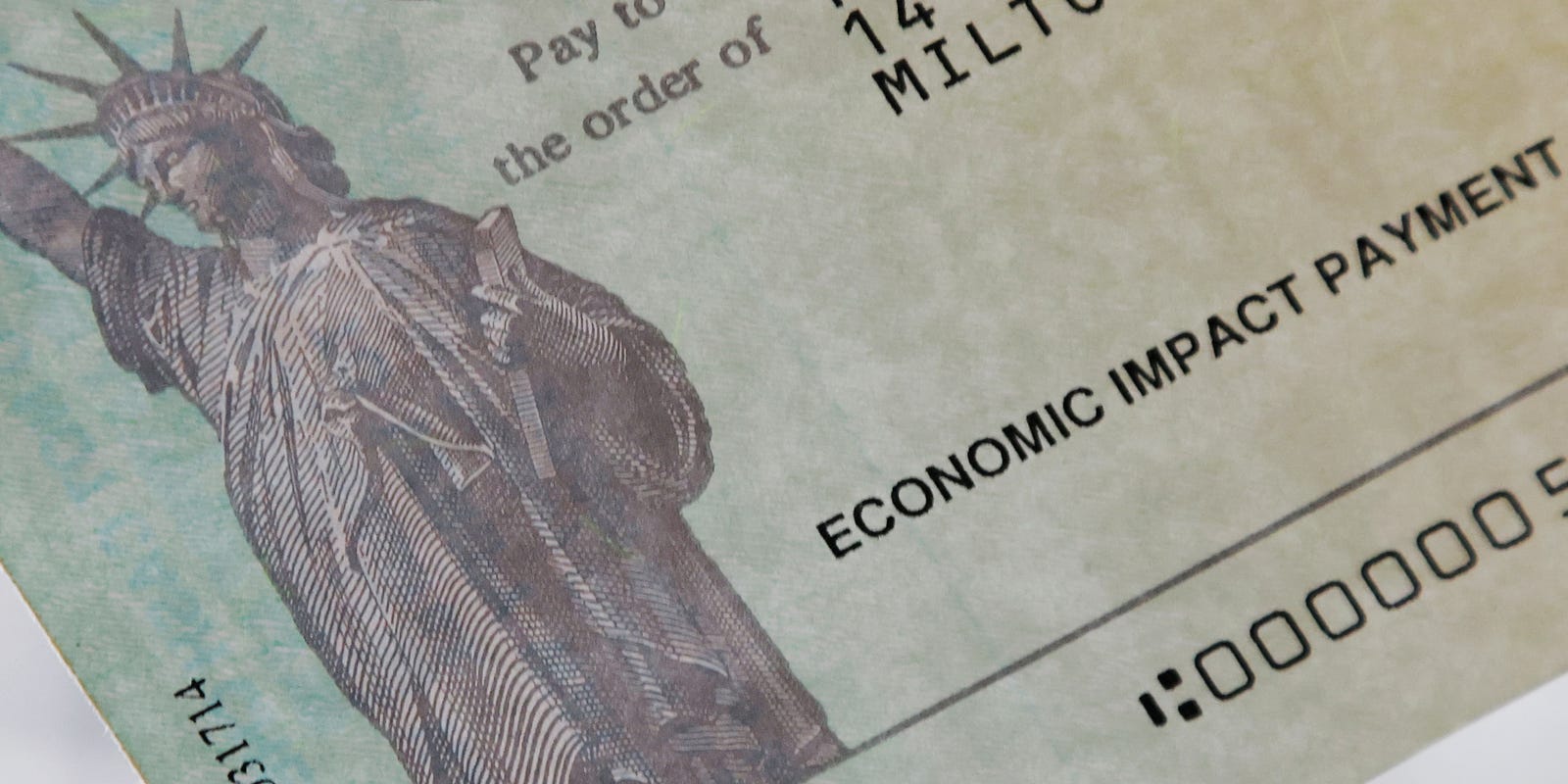

The first stimulus check arrived in 2020, followed by the second and third in 2021. However, the window to claim those payments has closed. The official deadline to file for the third stimulus check was April 15, 2025. Missing that deadline means forfeiting any unclaimed stimulus payments. The IRS keeps these funds. It’s crucial to remember that tax filing deadlines are strictly enforced. No extensions or appeals are available for those who missed the deadline.

So, what happened? Where did all the money go? The government issued the stimulus checks to provide financial relief during the COVID-19 pandemic. Many people struggled. The stimulus money was meant to help them cover essential expenses. But the deadlines have passed, and the IRS has the money. The details matter. So, make sure to pay attention to dates and requirements. This information is for guidance only; seek professional advice for specific financial situations.

The Elusive Fourth Stimulus Check: Separating Fact from Fiction

Rumors and speculations about a fourth stimulus check, potentially offering $2,000, have been circulating online. But are these claims credible? Unfortunately, there’s no official confirmation from either Congress or the IRS. Any such claims should be approached with caution. Social media can spread misinformation. Unverified websites may also be attempting fraud. It’s always best to rely on official sources. These include the IRS website and announcements from elected officials.

Furthermore, a plan proposed by former President Donald Trump involved a “DOGE dividend.” The plan proposed paying taxpayers $5,000 in stimulus checks. The money would come from savings identified by Musk’s Department of Government Efficiency. However, there have been no further details or confirmations about this plan since it was originally mentioned. This serves as a reminder of how quickly rumors spread, and to always verify information from reliable sources.

What is the truth? The truth is that there is no definitive answer. Do not expect a fourth stimulus check. Always be aware and informed. Look to verified sources of information when making financial decisions.

Tracking Your Tax Refund: When to Expect Your Money

While a fourth stimulus check may be unlikely, you can still focus on your tax refund. How can you track your federal tax refund? If you filed electronically and provided your banking details, direct deposits usually take about 21 days. If you didn’t provide banking information, you may receive a paper check within 6-8 weeks. However, there is no guarantee. It is important to remember that the IRS needs time to process your tax return. Submitting your tax return is not the same as it being accepted. You can find out if it has been accepted online by looking at the “Refund Sent” alert. This means the IRS has approved your refund. Your money should arrive in your bank account in a matter of days.

Where’s My Refund? The IRS has an online tool, “Where’s My Refund.” It allows you to check on your refund status. To use it, enter your Social Security number, filing status, and the exact refund amount. The tool then shows your refund status: “Return Received,” “Refund Approved,” or “Refund Sent.” The IRS updates this information overnight. You can also call the IRS at 800-829-1954 to check your refund status. Getting an accurate picture of when you will receive your money is essential.

What about the refund schedule for 2025? If you filed your taxes electronically and they were accepted by April 15th, you could expect your direct deposit federal refund from the IRS by May 6th, or June 16th by mail. Filing your taxes promptly and accurately is important. Keeping track of the details will save you trouble later.

State Tax Refund Status: How to Find Your Information

Most states also provide online portals where you can track your income tax returns. For example, the Delaware Division of Taxation has an online portal to check the status of your state refund. Also, Pennsylvania and New Jersey provide online portals for checking state tax refunds. To check your refund, visit the online portals. These can be found on each state’s official government website. It’s important to follow your state’s specific instructions.

State tax refund information can vary. Knowing the steps to take will help you track your money. It also gives you a better picture of your financial situation. Remember to keep your records organized for easy access. If you need help, consult a tax professional. They can guide you through the process.

As a reminder, the information provided here is for informational purposes only and does not constitute financial advice. For personalized advice, consult with a qualified financial advisor or tax professional.

Concluding Thoughts: Staying Informed and Managing Your Finances

The landscape of stimulus checks and tax refunds can be complex. Understanding the deadlines, verifying information, and utilizing available resources are critical for managing your finances. While the opportunity to claim past stimulus payments has passed, focusing on your tax refund and remaining informed about potential developments is essential.

Stay updated. Rely on trusted sources. Make smart financial decisions. These actions can help you successfully navigate your financial journey. Remember, you are in control. By taking the time to research, understand, and act, you can gain a sense of security and peace of mind, even in uncertain financial times.